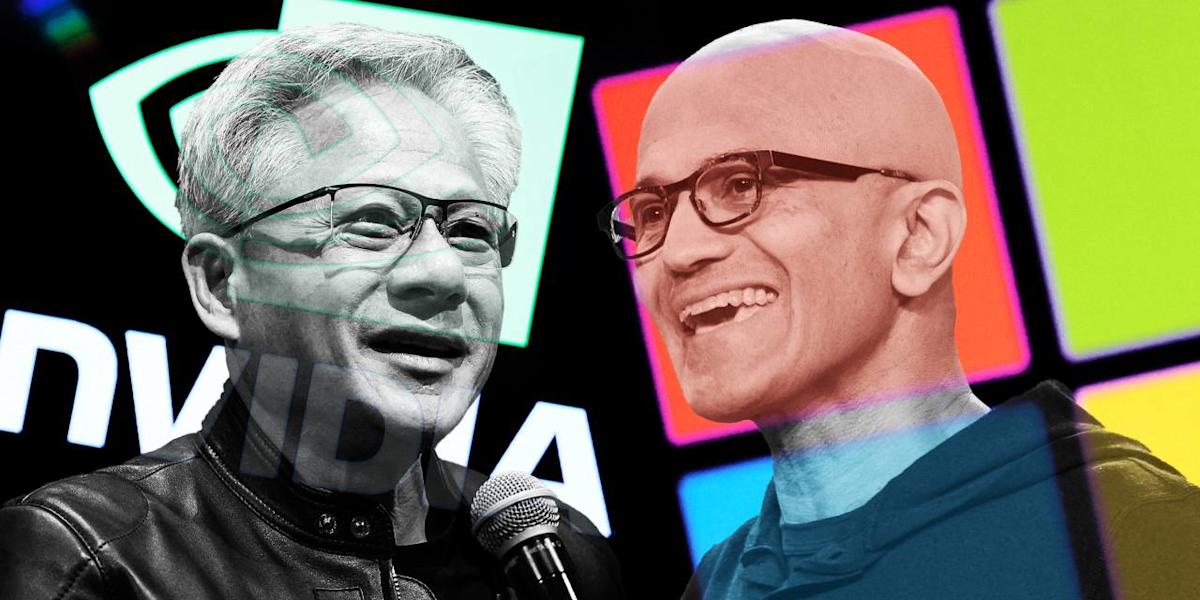

Nvidia and Microsoft could soon become $4 trillion companies, forming the most exclusive club in the stock market.

Enthusiasm over artificial intelligence is what got both of them there. But for Microsoft, the story is more complicated—and the payoff fuzzier.

A much bigger company than Nvidia in terms of annual revenue, Microsoft also sits in a different spot in the AI value chain. Nvidia is booming because any company that wants to work with AI has to buy its chips first. Microsoft’s boom will depend on the willingness of a high number of the customers it depends on—both businesses and consumers—to pay a premium for AI services.

For that to happen, AI will have to become a more transformative corporate tool fully woven through everyday life—much like Microsoft’s Windows operating system or Word office software became decades ago.

Many think that’s more a question of “when” than “if.” But the “when” still matters after Microsoft’s market value has grown by a trillion dollars in less than three months. And, at a market cap of $4 trillion, Microsoft’s stock price would command the highest multiple against projected earnings that it has sported in more than 20 years.

That leaves no room for error—and relatively little room even for speed bumps.

Microsoft has had some of those of late. Its early partnership with OpenAI gave the company a front seat in the AI rocket ship, allowing it to infuse the technology behind ChatGPT into its own products.

But that relationship has hit a rough patch. OpenAI wants to change its unusual corporate structure and become a regular for-profit company, part of a long-running effort to disentangle itself from a benefactor that is also a competitor.

Worryingly for Microsoft, OpenAI has the right to limit access to its future technology when it reaches “artificial general intelligence”—a nebulous threshold that could still deprive Microsoft of a crucial driver of its AI strategy.

Microsoft has also reportedly had trouble developing its own line of in-house AI chips that could lessen its dependence on Nvidia. Adding to the internal drama, the company confirmed Wednesday that it plans to lay off 9,000 more workers, on top of the 6,000 roles it eliminated in May.

Nvidia and Microsoft could soon become $4 trillion companies, forming the most exclusive club in the stock market.

Enthusiasm over artificial intelligence is what got both of them there. But for Microsoft, the story is more complicated—and the payoff fuzzier.

A much bigger company than Nvidia in terms of annual revenue, Microsoft also sits in a different spot in the AI value chain. Nvidia is booming because any company that wants to work with AI has to buy its chips first. Microsoft’s boom will depend on the willingness of a high number of the customers it depends on—both businesses and consumers—to pay a premium for AI services.

For that to happen, AI will have to become a more transformative corporate tool fully woven through everyday life—much like Microsoft’s Windows operating system or Word office software became decades ago.

Many think that’s more a question of “when” than “if.” But the “when” still matters after Microsoft’s market value has grown by a trillion dollars in less than three months. And, at a market cap of $4 trillion, Microsoft’s stock price would command the highest multiple against projected earnings that it has sported in more than 20 years.

That leaves no room for error—and relatively little room even for speed bumps.

Microsoft has had some of those of late. Its early partnership with OpenAI gave the company a front seat in the AI rocket ship, allowing it to infuse the technology behind ChatGPT into its own products.

But that relationship has hit a rough patch. OpenAI wants to change its unusual corporate structure and become a regular for-profit company, part of a long-running effort to disentangle itself from a benefactor that is also a competitor.

Worryingly for Microsoft, OpenAI has the right to limit access to its future technology when it reaches “artificial general intelligence”—a nebulous threshold that could still deprive Microsoft of a crucial driver of its AI strategy.

Microsoft has also reportedly had trouble developing its own line of in-house AI chips that could lessen its dependence on Nvidia. Adding to the internal drama, the company confirmed Wednesday that it plans to lay off 9,000 more workers, on top of the 6,000 roles it eliminated in May.

Leave feedback about this