(Bloomberg) — The hunt for winners in the artificial intelligence gold rush has landed on an unlikely target: old-line industrial equipment maker Caterpillar Inc.

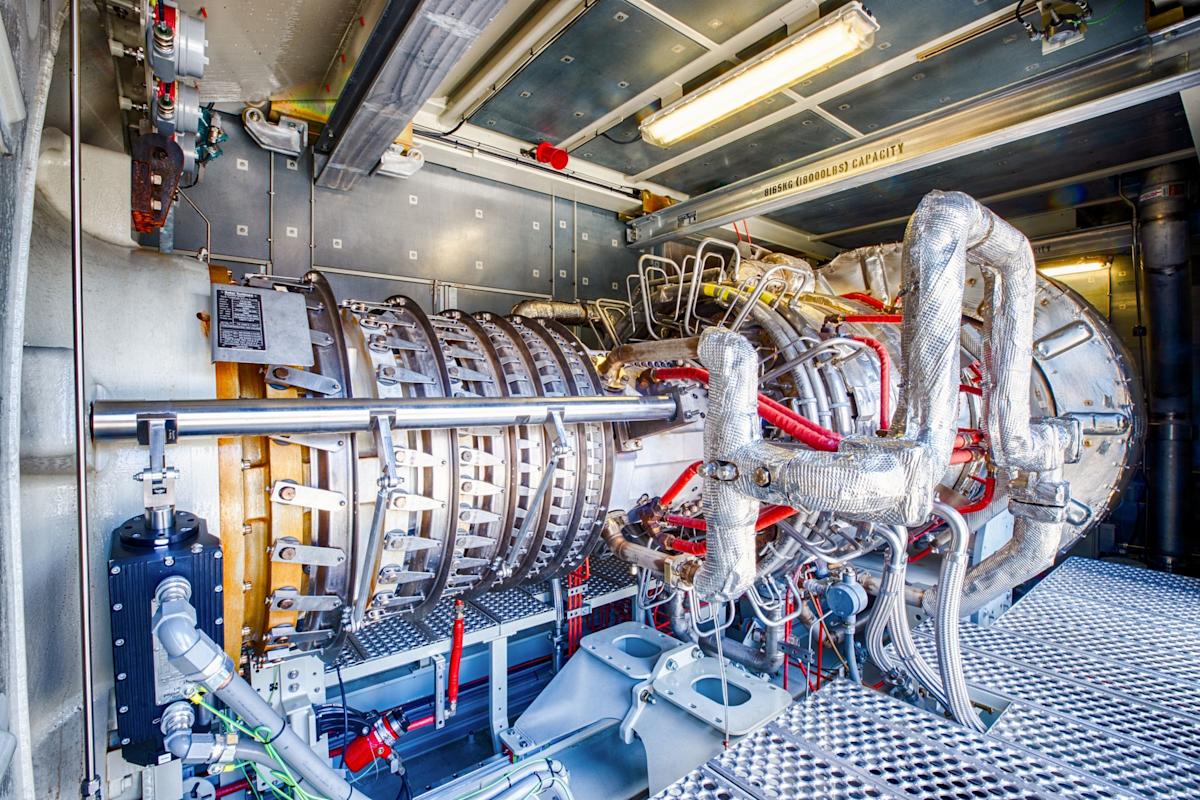

The iconic American company, known for its yellow excavators and bulldozers, closed September at an all-time high as investors bet AI’s nearly insatiable demand for electricity will fuel orders for one of Caterpillar’s lesser-known products — power-generation turbines.

Most Read from Bloomberg

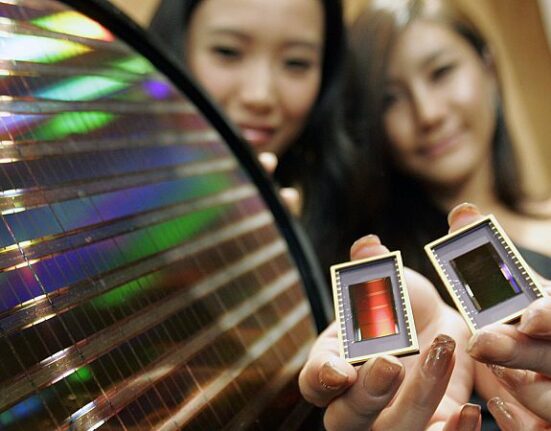

AI initially fueled dizzying rallies in chipmakers and software firms. Then, as the power demands became clear, a boom in shares of utilities and builders of data centers. Now, investors are moving further afield in search of beneficiaries from the hundreds of billions of dollars flowing into the build-out of the AI economy.

“You just saw a market that was thirsty for non-Magnificent Seven winners regarding, effectively, the information economy or the digital economy,” said Brian Sponheimer, a portfolio manager at Gamco Investors Inc.’s Gabelli.

Shares of Caterpillar surged 14% in September, the best month since December 2023. The rally brought the stock’s year-to-date gain to 32%, far outstripping the 17% gain in the technology-heavy Nasdaq 100 Index and the 19% advance in the cohort of the seven top US tech giants.

The stock advanced another 0.8% on Wednesday, with investors seemingly unperturbed after news that Dutch pension fund ABP had sold a €387 million ($455 million) stake in the company amid backlash over links to Israel’s war in Gaza.

The surge wasn’t entirely predicated on Caterpillar’s turbines business. The shares had slumped after the company warned at the end of August that it expects tariffs to cost it as much as $1.8 billion this year, crimping profit margins. But the manufacturer has a record backlog of nearly $40 billion as of the end of June, softening the blow from higher costs for steel and aluminum. It also stands to pay lower taxes thanks to Congress’s spending bill. The Federal Reserve’s first rate cut this year helped, as well.

The September rally, though, gained momentum after Oracle Corp. delivered a unexpectedly robust forecast for its cloud computing business — a unit that will require massive amounts of electricity and processing power. To meet that kind of demand from the tech sector, investors are betting, Caterpillar’s turbines will be needed. The company’s shares jumped in eight of the nine trading sessions after Oracle’s forecast.

(Bloomberg) — The hunt for winners in the artificial intelligence gold rush has landed on an unlikely target: old-line industrial equipment maker Caterpillar Inc.

The iconic American company, known for its yellow excavators and bulldozers, closed September at an all-time high as investors bet AI’s nearly insatiable demand for electricity will fuel orders for one of Caterpillar’s lesser-known products — power-generation turbines.

Most Read from Bloomberg

AI initially fueled dizzying rallies in chipmakers and software firms. Then, as the power demands became clear, a boom in shares of utilities and builders of data centers. Now, investors are moving further afield in search of beneficiaries from the hundreds of billions of dollars flowing into the build-out of the AI economy.

“You just saw a market that was thirsty for non-Magnificent Seven winners regarding, effectively, the information economy or the digital economy,” said Brian Sponheimer, a portfolio manager at Gamco Investors Inc.’s Gabelli.

Shares of Caterpillar surged 14% in September, the best month since December 2023. The rally brought the stock’s year-to-date gain to 32%, far outstripping the 17% gain in the technology-heavy Nasdaq 100 Index and the 19% advance in the cohort of the seven top US tech giants.

The stock advanced another 0.8% on Wednesday, with investors seemingly unperturbed after news that Dutch pension fund ABP had sold a €387 million ($455 million) stake in the company amid backlash over links to Israel’s war in Gaza.

The surge wasn’t entirely predicated on Caterpillar’s turbines business. The shares had slumped after the company warned at the end of August that it expects tariffs to cost it as much as $1.8 billion this year, crimping profit margins. But the manufacturer has a record backlog of nearly $40 billion as of the end of June, softening the blow from higher costs for steel and aluminum. It also stands to pay lower taxes thanks to Congress’s spending bill. The Federal Reserve’s first rate cut this year helped, as well.

The September rally, though, gained momentum after Oracle Corp. delivered a unexpectedly robust forecast for its cloud computing business — a unit that will require massive amounts of electricity and processing power. To meet that kind of demand from the tech sector, investors are betting, Caterpillar’s turbines will be needed. The company’s shares jumped in eight of the nine trading sessions after Oracle’s forecast.

Leave feedback about this