When Sriram Krishnan, a senior White House policy advisor on artificial intelligence, appeared onstage at an event in Washington last month, he listed the Trump administration’s priorities for advancing the AI revolution.

At the top of the list? More construction.

“Let’s make sure we build our infrastructure,” Krishnan said. “‘Build, baby, build’ is what we tell people.”

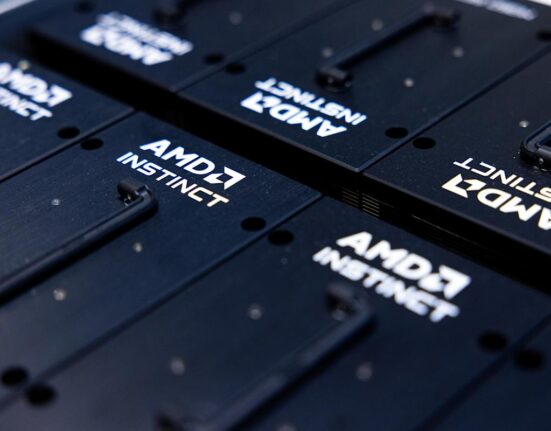

That rallying cry is echoing across Silicon Valley. Executives at Meta say they expect to spend $600 billion on AI infrastructure, including massive data centers, through 2028. OpenAI and Oracle have announced plans to put $500 billion into a data center project dubbed Stargate, while Amazon plans to spend more than $30 billion on capital expenditures, or capex, in each of the next two quarters.

The problem: The business case for AI remains untested, and it’s unclear whether the revenue from AI products will justify the ever-growing spending. If it does, it could push the economy onto a higher growth curve and transform entire industries. If it doesn’t, the fallout could reshape the economy — from stock market crashes to communities left with vast, vacant data centers.

Earlier this year, Business Insider published an investigation into the data center industry, creating the most comprehensive map to date of where data centers are in the US. The investigation found 1,240 data centers in America already built or approved for construction at the end of 2024, an almost fourfold increase since 2010. The data didn’t include any projects that received permits this year.

This year, four of the five biggest energy users from our tally, Amazon, Meta, Microsoft, and Google, could spend an estimated $320 billion on capex, primarily for AI infrastructure, according to an analysis of financial statements by Business Insider. That’s more than the GDP of Finland and just shy of the total revenue ExxonMobil earned in 2024.

The scale of the investment is sparking concerns about a bubble and the potential for a pop that could bring the stock market crashing down from record heights.

So far, the concerns haven’t spooked investors. The tech-heavy Nasdaq is up 19% this year, with Nvidia, the world’s largest company by market capitalization, Google, and Microsoft all up more than 25%. Oracle has seen its stock rise 75% this year.

The money spent this year on AI infrastructure and software has contributed more to GDP growth than consumer spending, according to Renaissance Macro Research’s reading of Bureau of Economic Analysis data.

When Sriram Krishnan, a senior White House policy advisor on artificial intelligence, appeared onstage at an event in Washington last month, he listed the Trump administration’s priorities for advancing the AI revolution.

At the top of the list? More construction.

“Let’s make sure we build our infrastructure,” Krishnan said. “‘Build, baby, build’ is what we tell people.”

That rallying cry is echoing across Silicon Valley. Executives at Meta say they expect to spend $600 billion on AI infrastructure, including massive data centers, through 2028. OpenAI and Oracle have announced plans to put $500 billion into a data center project dubbed Stargate, while Amazon plans to spend more than $30 billion on capital expenditures, or capex, in each of the next two quarters.

The problem: The business case for AI remains untested, and it’s unclear whether the revenue from AI products will justify the ever-growing spending. If it does, it could push the economy onto a higher growth curve and transform entire industries. If it doesn’t, the fallout could reshape the economy — from stock market crashes to communities left with vast, vacant data centers.

Earlier this year, Business Insider published an investigation into the data center industry, creating the most comprehensive map to date of where data centers are in the US. The investigation found 1,240 data centers in America already built or approved for construction at the end of 2024, an almost fourfold increase since 2010. The data didn’t include any projects that received permits this year.

This year, four of the five biggest energy users from our tally, Amazon, Meta, Microsoft, and Google, could spend an estimated $320 billion on capex, primarily for AI infrastructure, according to an analysis of financial statements by Business Insider. That’s more than the GDP of Finland and just shy of the total revenue ExxonMobil earned in 2024.

The scale of the investment is sparking concerns about a bubble and the potential for a pop that could bring the stock market crashing down from record heights.

So far, the concerns haven’t spooked investors. The tech-heavy Nasdaq is up 19% this year, with Nvidia, the world’s largest company by market capitalization, Google, and Microsoft all up more than 25%. Oracle has seen its stock rise 75% this year.

The money spent this year on AI infrastructure and software has contributed more to GDP growth than consumer spending, according to Renaissance Macro Research’s reading of Bureau of Economic Analysis data.

Leave feedback about this