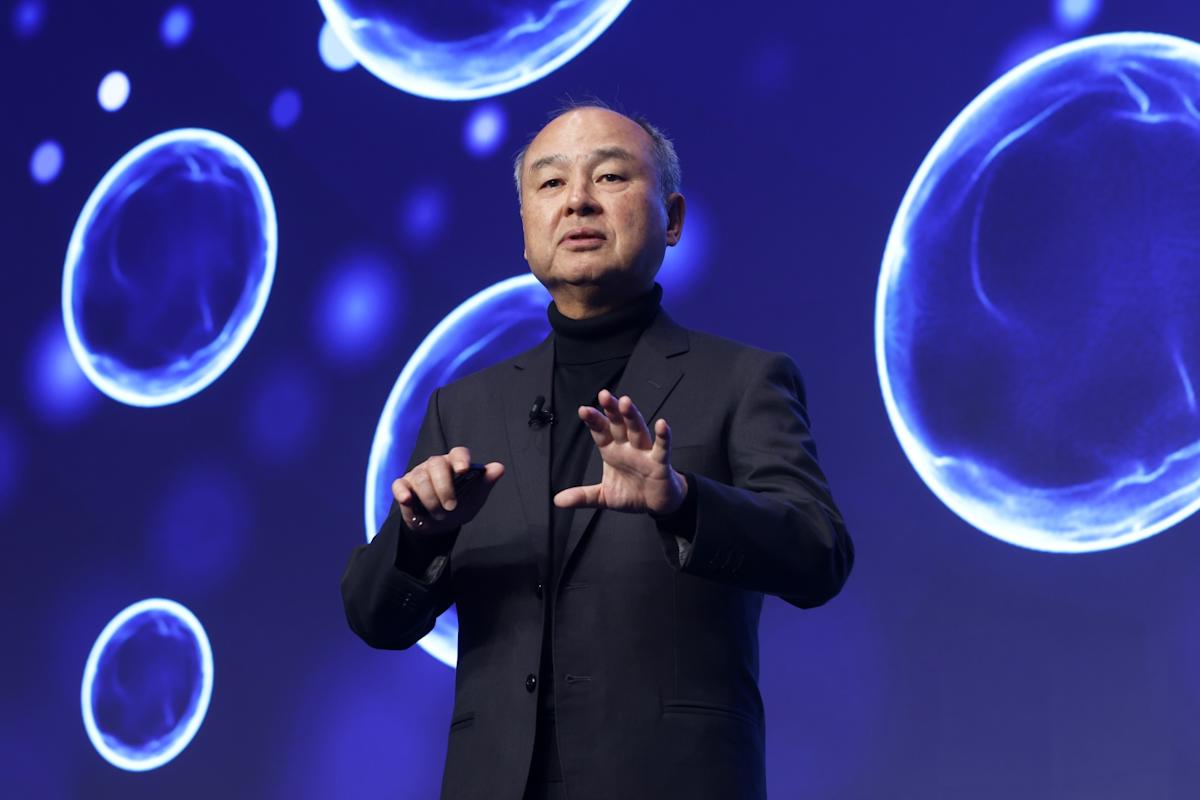

(Bloomberg) — SoftBank Group Corp. (9984.T, SFTBY, SFTBF) is in talks to borrow $5 billion from global banks, refilling its coffers at a time Masayoshi Son is accelerating the Japanese investment firm’s bets on artificial intelligence.

Most Read from Bloomberg

SoftBank is close to signing a deal with a handful of lenders for a margin loan secured by shares of its chip unit Arm Holdings Plc. (ARM), people familiar with the matter said. The capital will fund additional investment in OpenAI this year, the people said, who asked not to be identified discussing private matters.

A margin loan is a type of facility where you borrow money using your investments — like stocks — as collateral. A representative for SoftBank declined to comment.

Founder Son has embarked on a spending spree this year to try and position the firm as a linchpin in the global AI boom, most recently pledging as much as $30 billion toward OpenAI and buying ABB Ltd.’s robotics arm for $5.4 billion. Arm’s 38% rally this year has in turn granted SoftBank the confidence and leeway to grow its investment war chest.

SoftBank has raised a total of $13.5 billion in margin loans from Arm shares, with $5 billion still undrawn, as of March 2025, according to its earnings statement. The latest facility will increase the total to $18.5 billion.

The group had secured about $8 billion in margin loans ahead of Arm’s initial public offering in 2023. Eleven banks including JPMorgan Chase & Co., Barclays Plc, BNP Paribas SA, Credit Agricole Corporate and Investment Bank and Goldman Sachs Group Inc. provided the facilities by linking mandates for Arm’s IPO to the loans. Earlier this year, the group also raised a $15 billion one-year facility to help fund AI investments in the US, in what is among its largest borrowings raised.

Why Fears of a Trillion-Dollar AI Bubble Are Growing: QuickTake

Son’s insatiable appetite for deals has extended far and wide, centered on ideas to capitalize on the expected exponential growth of AI technologies.

His most ambitious projects include a $500 billion Stargate initiative that aims to build data centers across the US in partnership with OpenAI and Oracle Corp. SoftBank is also exploring the feasibility of a large-scale industrial manufacturing hub in the US, which could encompass production lines for AI-powered industrial robots, Bloomberg News has reported.

(Bloomberg) — SoftBank Group Corp. (9984.T, SFTBY, SFTBF) is in talks to borrow $5 billion from global banks, refilling its coffers at a time Masayoshi Son is accelerating the Japanese investment firm’s bets on artificial intelligence.

Most Read from Bloomberg

SoftBank is close to signing a deal with a handful of lenders for a margin loan secured by shares of its chip unit Arm Holdings Plc. (ARM), people familiar with the matter said. The capital will fund additional investment in OpenAI this year, the people said, who asked not to be identified discussing private matters.

A margin loan is a type of facility where you borrow money using your investments — like stocks — as collateral. A representative for SoftBank declined to comment.

Founder Son has embarked on a spending spree this year to try and position the firm as a linchpin in the global AI boom, most recently pledging as much as $30 billion toward OpenAI and buying ABB Ltd.’s robotics arm for $5.4 billion. Arm’s 38% rally this year has in turn granted SoftBank the confidence and leeway to grow its investment war chest.

SoftBank has raised a total of $13.5 billion in margin loans from Arm shares, with $5 billion still undrawn, as of March 2025, according to its earnings statement. The latest facility will increase the total to $18.5 billion.

The group had secured about $8 billion in margin loans ahead of Arm’s initial public offering in 2023. Eleven banks including JPMorgan Chase & Co., Barclays Plc, BNP Paribas SA, Credit Agricole Corporate and Investment Bank and Goldman Sachs Group Inc. provided the facilities by linking mandates for Arm’s IPO to the loans. Earlier this year, the group also raised a $15 billion one-year facility to help fund AI investments in the US, in what is among its largest borrowings raised.

Why Fears of a Trillion-Dollar AI Bubble Are Growing: QuickTake

Son’s insatiable appetite for deals has extended far and wide, centered on ideas to capitalize on the expected exponential growth of AI technologies.

His most ambitious projects include a $500 billion Stargate initiative that aims to build data centers across the US in partnership with OpenAI and Oracle Corp. SoftBank is also exploring the feasibility of a large-scale industrial manufacturing hub in the US, which could encompass production lines for AI-powered industrial robots, Bloomberg News has reported.

Leave feedback about this