-

Investors are heading into a pivotal earnings report for Tesla.

-

Focus will be on updates regarding robotaxis and AI plans.

-

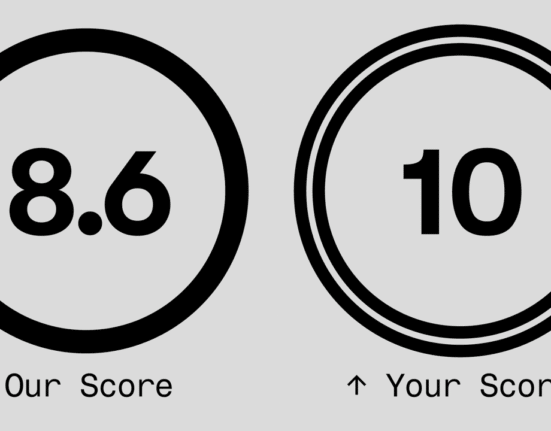

The stock has been on a wild ride in 2025 and is currently up about 10% year-to-date.

Earnings day is here for Tesla, and the stakes are high.

After a roller coaster ride for the stock in 2025, shares are now up 95% in six months, but even with such a massive gain, that only amounts to a rise of about 10% year-to-date.

Now, investors will get a sense of whether the rally that’s taken hold in the latter half of the year can continue. They’ll be laser-focused on updates on Tesla’s robotaxi rollout, which many on Wall Street see as the justification for the EV maker’s premium valuation.

There will also be questions about the outlook for vehicle sales after Tesla reported deliveries earlier this month that crushed estimates. However, with the federal EV tax credit now off the table, some have wondered if sales will wane in the coming quarters.

Tesla will publish its results shortly after the 4 p.m. ET closing bell, with the analyst call scheduled for 5:30.

Wall Street expects Tesla to report revenue of $26.3 billion, EPS of $.042

THIRD QUARTER

-

Adjusted EPS estimate 54c (Bloomberg Consensus)

-

EPS estimate 42c

-

Revenue estimate $26.36 billion

-

Gross margin estimate 17.2%

-

Operating income estimate $1.65 billion

-

Free cash flow estimate $1.25 billion

-

Capital expenditure estimate $2.84 billion

YEAR

-

Production estimate 1.72 million

-

Deliveries estimate 1.63 million

-

Capital expenditure estimate $10 billion

Source: Bloomberg

Read the original article on Business Insider

-

Investors are heading into a pivotal earnings report for Tesla.

-

Focus will be on updates regarding robotaxis and AI plans.

-

The stock has been on a wild ride in 2025 and is currently up about 10% year-to-date.

Earnings day is here for Tesla, and the stakes are high.

After a roller coaster ride for the stock in 2025, shares are now up 95% in six months, but even with such a massive gain, that only amounts to a rise of about 10% year-to-date.

Now, investors will get a sense of whether the rally that’s taken hold in the latter half of the year can continue. They’ll be laser-focused on updates on Tesla’s robotaxi rollout, which many on Wall Street see as the justification for the EV maker’s premium valuation.

There will also be questions about the outlook for vehicle sales after Tesla reported deliveries earlier this month that crushed estimates. However, with the federal EV tax credit now off the table, some have wondered if sales will wane in the coming quarters.

Tesla will publish its results shortly after the 4 p.m. ET closing bell, with the analyst call scheduled for 5:30.

Wall Street expects Tesla to report revenue of $26.3 billion, EPS of $.042

THIRD QUARTER

-

Adjusted EPS estimate 54c (Bloomberg Consensus)

-

EPS estimate 42c

-

Revenue estimate $26.36 billion

-

Gross margin estimate 17.2%

-

Operating income estimate $1.65 billion

-

Free cash flow estimate $1.25 billion

-

Capital expenditure estimate $2.84 billion

YEAR

-

Production estimate 1.72 million

-

Deliveries estimate 1.63 million

-

Capital expenditure estimate $10 billion

Source: Bloomberg

Read the original article on Business Insider

Leave feedback about this