(Bloomberg) — China’s markets reopen on Thursday after the Golden Week break with investors weighing whether renewed enthusiasm for artificial intelligence can outweigh signs of soft consumer spending.

Holiday data showed households remained cautious. Spending was restrained, with cheaper road trips replacing flights and box office sales missing expectations. The weakness in consumption comes alongside an artificial intelligence frenzy that sent global tech stocks to fresh highs while China was shut, fueled by firms touting OpenAI ties.

Most Read from Bloomberg

Overall, a gauge tracking large mainland stocks listed in Hong Kong has declined 0.3% over the period when Chinese markets were closed. The offshore yuan edged lower during the break. Traders are watching for policy signals ahead of the Communist Party’s Oct. 20-23 meeting, where the blueprint for the 15th five-year plan will be outlined. The Trump-Xi meeting at next month’s APEC summit in South Korea could add another catalyst if tariff talks resume.

“Early macro data I’m seeing for tourism during the holiday wasn’t great,” said Xin-Yao Ng, a fund manager at Aberdeen Investments. “I suspect at best flattish to slightly down if there isn’t new and better data coming out later,” he added, referring to the mainland stock market open.

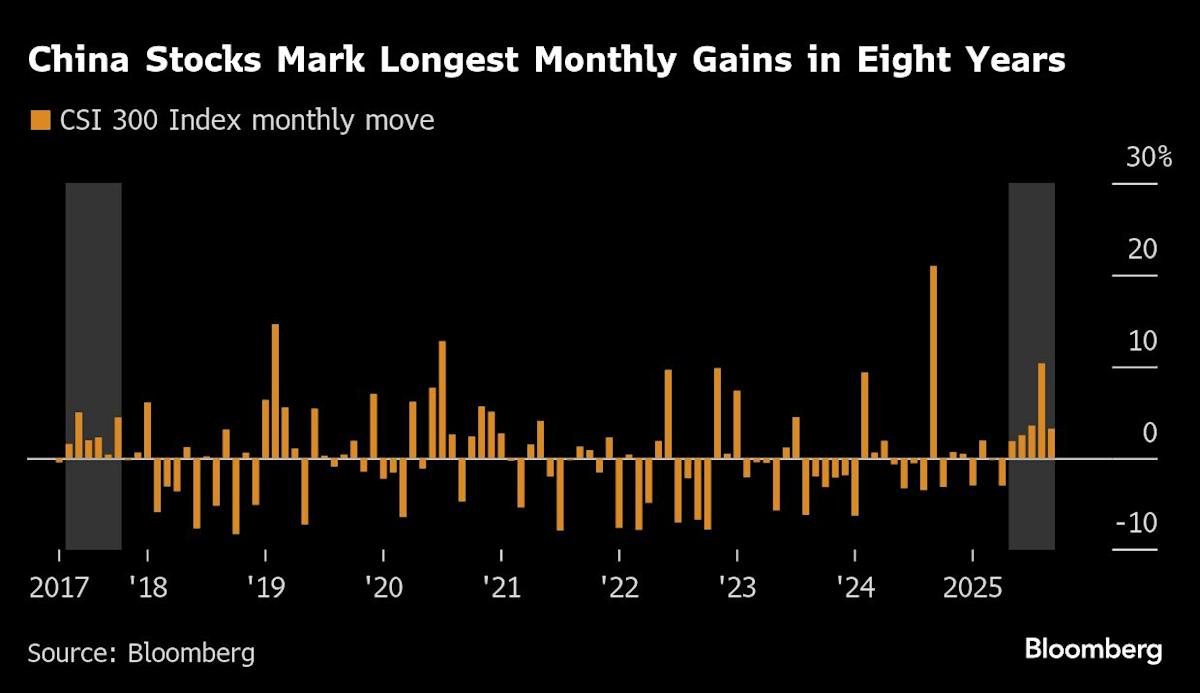

The CSI 300 Index has climbed for five straight months through September, its longest winning streak since 2017, led by enthusiasm over chip stocks after DeepSeek’s unveiling of an updated AI model and Huawei Technologies Co.’s plan to double output of its top AI chips. The gauge is up 18% this year.

Despite the rally, Chinese equities remain much cheaper than their peers. The MSCI China Index traded at below 14 times forward earnings — far below the S&P 500’s valuation at 23 times, according to Bloomberg-compiled data.

“If high-growth Chinese names, particularly in the internet space, can deliver on their potential earnings, they’re looking very attractive relative to global peers,” said Ian Samson, a multi-asset portfolio manager at Fidelity International in Singapore.

Weak Spending

Golden Week spending reflected consumers’ budget-conscious behavior. Travel and experiences remain a priority, but box office figures and airline demand disappointed.

(Bloomberg) — China’s markets reopen on Thursday after the Golden Week break with investors weighing whether renewed enthusiasm for artificial intelligence can outweigh signs of soft consumer spending.

Holiday data showed households remained cautious. Spending was restrained, with cheaper road trips replacing flights and box office sales missing expectations. The weakness in consumption comes alongside an artificial intelligence frenzy that sent global tech stocks to fresh highs while China was shut, fueled by firms touting OpenAI ties.

Most Read from Bloomberg

Overall, a gauge tracking large mainland stocks listed in Hong Kong has declined 0.3% over the period when Chinese markets were closed. The offshore yuan edged lower during the break. Traders are watching for policy signals ahead of the Communist Party’s Oct. 20-23 meeting, where the blueprint for the 15th five-year plan will be outlined. The Trump-Xi meeting at next month’s APEC summit in South Korea could add another catalyst if tariff talks resume.

“Early macro data I’m seeing for tourism during the holiday wasn’t great,” said Xin-Yao Ng, a fund manager at Aberdeen Investments. “I suspect at best flattish to slightly down if there isn’t new and better data coming out later,” he added, referring to the mainland stock market open.

The CSI 300 Index has climbed for five straight months through September, its longest winning streak since 2017, led by enthusiasm over chip stocks after DeepSeek’s unveiling of an updated AI model and Huawei Technologies Co.’s plan to double output of its top AI chips. The gauge is up 18% this year.

Despite the rally, Chinese equities remain much cheaper than their peers. The MSCI China Index traded at below 14 times forward earnings — far below the S&P 500’s valuation at 23 times, according to Bloomberg-compiled data.

“If high-growth Chinese names, particularly in the internet space, can deliver on their potential earnings, they’re looking very attractive relative to global peers,” said Ian Samson, a multi-asset portfolio manager at Fidelity International in Singapore.

Weak Spending

Golden Week spending reflected consumers’ budget-conscious behavior. Travel and experiences remain a priority, but box office figures and airline demand disappointed.

Leave feedback about this