On the morning of Oct. 20, 2025, Amazon Web Services (AWS) experienced a major outage that cascaded into widespread service disruptions across thousands of websites and applications.

Several large exchanges and crypto-service providers rely heavily on cloud infrastructure like AWS to power their trading platforms, wallets, analytics tools and matching engines.

The ripple effect hit the crypto world: Coinbase reported that its trading platform and its Base layer-2 network both went down. ConsenSys’ Infura and Robinhood similarly suffered during the outage.

Almost immediately, the crypto community took to social media to sound the alarm that some of the industry’s most recognizable companies are too reliant on centralized infrastructure.

“If your blockchain is down because of the AWS outage, you’re not sufficiently decentralized,” said Ben Schiller, the Head of Communications at Miden and a former CoinDesk editor, on X.

Maggie Love, the creator of SheFi, reiterated that sentiment on X: “If we cannot connect to ethereum mainnet when AWS goes down, we are not decentralized.”

This wasn’t the first time the cloud giant caused tremors across the crypto landscape. In April 2025, AWS suffered another widespread disruption that knocked several crypto exchanges and infrastructure providers offline.

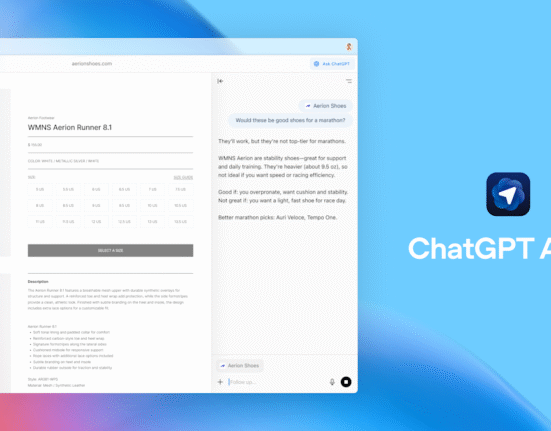

Meanwhile, infrastructure provider Infura, which offers backend JSON-RPC and WebSocket APIs that help wallets and apps connect to blockchains, shared on Monday that the outage disrupted multiple network endpoints. “Ethereum Mainnet, Polygon, Optimism, Arbitrum, Linea, Base and Scroll” were all affected due to a “reoccurring issue … related to an ongoing AWS outage.”

With Infura’s support impaired, front-end access for many applications stalled. Even though the distributed consensus layers remained intact, the gateways through which most users interact with blockchains went offline, amplifying the disruption.

For layer-2 networks such as Polygon, Arbitrum, Optimism, Linea, Scroll, and Base, the incident exposed a central irony: though these systems are designed to decentralize execution and scale, many of their front-ends, onboarding systems, infrastructure gateways and API layers still depend on centralized cloud services. The outage underscores a persistent tension within crypto — protocols that champion decentralization still often rely on centralized infrastructure for critical operations. Even if blockchain nodes are distributed, the trading engines, custody platforms and relayers that connect users to them typically run on a handful of major cloud providers, creating single points of failure.

On the morning of Oct. 20, 2025, Amazon Web Services (AWS) experienced a major outage that cascaded into widespread service disruptions across thousands of websites and applications.

Several large exchanges and crypto-service providers rely heavily on cloud infrastructure like AWS to power their trading platforms, wallets, analytics tools and matching engines.

The ripple effect hit the crypto world: Coinbase reported that its trading platform and its Base layer-2 network both went down. ConsenSys’ Infura and Robinhood similarly suffered during the outage.

Almost immediately, the crypto community took to social media to sound the alarm that some of the industry’s most recognizable companies are too reliant on centralized infrastructure.

“If your blockchain is down because of the AWS outage, you’re not sufficiently decentralized,” said Ben Schiller, the Head of Communications at Miden and a former CoinDesk editor, on X.

Maggie Love, the creator of SheFi, reiterated that sentiment on X: “If we cannot connect to ethereum mainnet when AWS goes down, we are not decentralized.”

This wasn’t the first time the cloud giant caused tremors across the crypto landscape. In April 2025, AWS suffered another widespread disruption that knocked several crypto exchanges and infrastructure providers offline.

Meanwhile, infrastructure provider Infura, which offers backend JSON-RPC and WebSocket APIs that help wallets and apps connect to blockchains, shared on Monday that the outage disrupted multiple network endpoints. “Ethereum Mainnet, Polygon, Optimism, Arbitrum, Linea, Base and Scroll” were all affected due to a “reoccurring issue … related to an ongoing AWS outage.”

With Infura’s support impaired, front-end access for many applications stalled. Even though the distributed consensus layers remained intact, the gateways through which most users interact with blockchains went offline, amplifying the disruption.

For layer-2 networks such as Polygon, Arbitrum, Optimism, Linea, Scroll, and Base, the incident exposed a central irony: though these systems are designed to decentralize execution and scale, many of their front-ends, onboarding systems, infrastructure gateways and API layers still depend on centralized cloud services. The outage underscores a persistent tension within crypto — protocols that champion decentralization still often rely on centralized infrastructure for critical operations. Even if blockchain nodes are distributed, the trading engines, custody platforms and relayers that connect users to them typically run on a handful of major cloud providers, creating single points of failure.

Leave feedback about this