Everyone’s watching artificial intelligence (AI) chips, rare earths, and semiconductors — but the real story might be the one metal at the heart of all these investing themes: Copper.

Known as “Dr. Copper” for its historical ability to “diagnose” the health of the global economy, copper is becoming the heartbeat of the energy transition, AI infrastructure, and clean-tech growth.

And while market headlines focus on big movers like Nvidia (NVDA) and Lithium Americas (LAC), copper (HGZ25) quietly just became one of the most important commodities of the next decade.

According to Wood Mackenzie, copper demand is projected to jump 24% by 2035, driven by:

-

Electric vehicles and charging networks

-

Renewable power grids

-

AI data centers that require massive electrical infrastructure

-

Defense and industrial spending

That surge represents over 7 million tons of new demand, but meeting it won’t be easy. It would require an estimated $210 billion in new mining investment and 8 million tons of new capacity per year.

As Western producers hesitate, other nations are stepping in. China, Russia, and Middle Eastern investors are funding mines across Africa, Asia, and Latin America.

This is gradually shifting control of future copper supply toward the East, giving emerging economies a larger role in global industrial and energy infrastructure. Meanwhile, expanding tariffs in the U.S. and policy headlines tied to metals and manufacturing have kept traders laser-focused on copper and mining stocks.

Every AI data center, electric vehicle, and renewable power line runs on copper. AI chips get all the attention, but without copper wiring and transformers, the world’s next-gen compute networks can’t even turn on.

That’s why some market-watchers are starting to call copper “the real AI trade.”

Historically, when copper prices rise, it signals economic expansion. When they fall, it can warn of a slowdown. But in today’s market, rising copper may be signaling something bigger — a structural supercycle driven by technology and electrification.

Copper prices are already up roughly 19% in 2025, and many analysts think it’s just the beginning. If supply can’t keep up, prices could eventually push toward $6 per pound or higher in the next few years.

Everyone’s watching artificial intelligence (AI) chips, rare earths, and semiconductors — but the real story might be the one metal at the heart of all these investing themes: Copper.

Known as “Dr. Copper” for its historical ability to “diagnose” the health of the global economy, copper is becoming the heartbeat of the energy transition, AI infrastructure, and clean-tech growth.

And while market headlines focus on big movers like Nvidia (NVDA) and Lithium Americas (LAC), copper (HGZ25) quietly just became one of the most important commodities of the next decade.

According to Wood Mackenzie, copper demand is projected to jump 24% by 2035, driven by:

-

Electric vehicles and charging networks

-

Renewable power grids

-

AI data centers that require massive electrical infrastructure

-

Defense and industrial spending

That surge represents over 7 million tons of new demand, but meeting it won’t be easy. It would require an estimated $210 billion in new mining investment and 8 million tons of new capacity per year.

As Western producers hesitate, other nations are stepping in. China, Russia, and Middle Eastern investors are funding mines across Africa, Asia, and Latin America.

This is gradually shifting control of future copper supply toward the East, giving emerging economies a larger role in global industrial and energy infrastructure. Meanwhile, expanding tariffs in the U.S. and policy headlines tied to metals and manufacturing have kept traders laser-focused on copper and mining stocks.

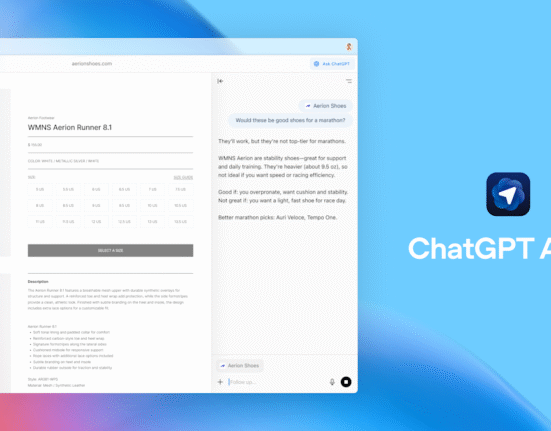

Every AI data center, electric vehicle, and renewable power line runs on copper. AI chips get all the attention, but without copper wiring and transformers, the world’s next-gen compute networks can’t even turn on.

That’s why some market-watchers are starting to call copper “the real AI trade.”

Historically, when copper prices rise, it signals economic expansion. When they fall, it can warn of a slowdown. But in today’s market, rising copper may be signaling something bigger — a structural supercycle driven by technology and electrification.

Copper prices are already up roughly 19% in 2025, and many analysts think it’s just the beginning. If supply can’t keep up, prices could eventually push toward $6 per pound or higher in the next few years.

Leave feedback about this