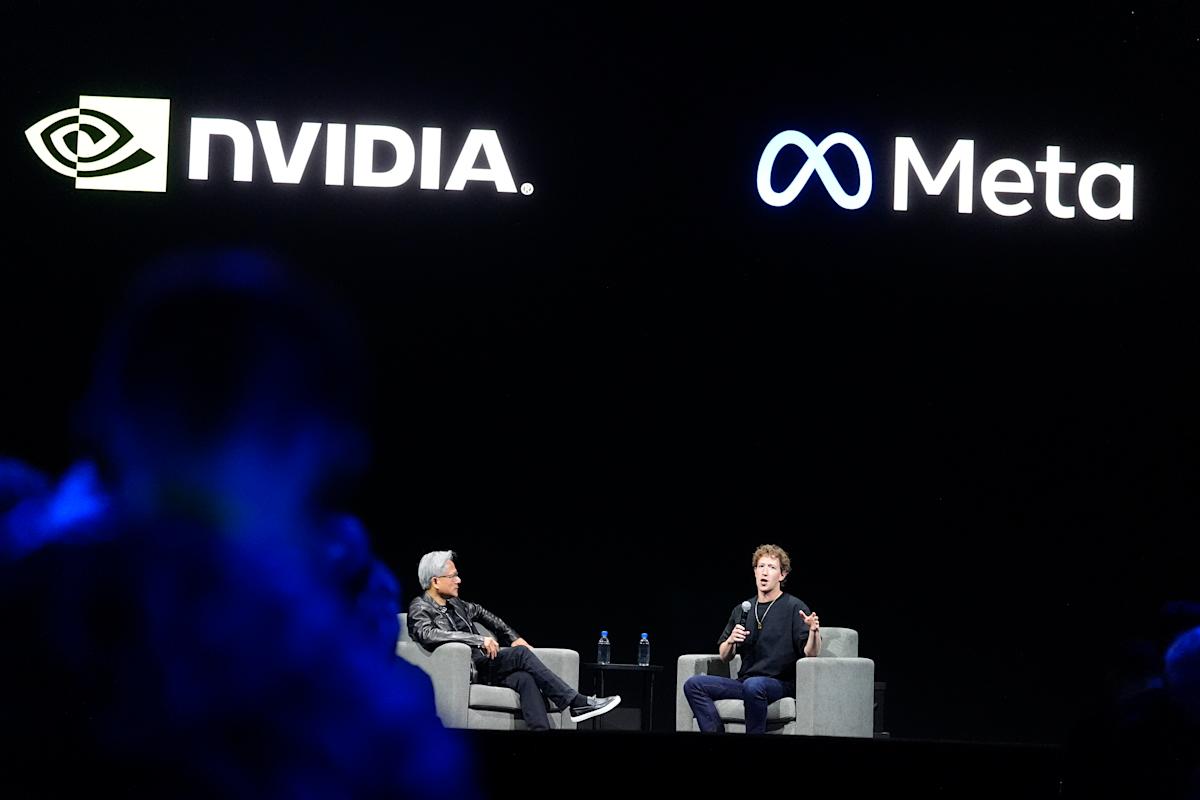

Nvidia’s (NVDA) own Big Tech customers are poised to capture a sizable slice of the AI chip market — a dynamic that could eventually dig into the chipmaker’s profit margins.

Tech giants have been making moves to bolster their in-house chipmaking businesses. ChatGPT developer OpenAI (OPAI.PVT) — a big customer of Nvidia’s chips by way of renting cloud space in Microsoft’s (MSFT) and CoreWeave’s (CRWV) data centers — said it will begin designing its own custom chips in partnership with Broadcom.

Meta (META) announced a plan in late September to acquire chip startup Rivos as it bolsters its own in-house chip efforts. Amazon (AMZN) said this summer that its massive data center project called Project Rainier, in which hundreds of thousands of its Trainium2 chips that will be used by AI developer Anthropic, is “well underway,” and analysts have said demand for its chips that have already been deployed in data centers from Anthropic has significantly risen.

While the lion’s share of the AI chip market is dominated by Nvidia’s GPUs (graphics processing units), tech companies led by Alphabet-owned Google (GOOGL, GOOG), Amazon, and Microsoft design custom chips in partnership with chipmakers Broadcom and Marvell Technology (MRVL).

The chips are cheaper and better optimized for those companies’ software, analysts explained. While these Big Tech cloud providers don’t sell physical, standalone chips to other companies like Nvidia does, the firms internally run their AI models off their own chips, and their cloud customers also have the option to run AI workloads using those custom chips at a lower cost.

JPMorgan said in a research note in June that custom chips designed by companies like Google, Amazon, Meta, and OpenAI will account for 45% of the AI chip market by 2028, up from 37% in 2024 and 40% in 2025. The rest of the chip market is held by producers of GPUs, namely Nvidia and its rival Advanced Micro Devices (AMD).

The “Magnificent Seven” names have a good reason to design their own chips.

“In the case of all the hyperscalers looking at custom silicon, the strategic angle here is they don’t want to be stuck behind an NVIDIA monopoly,” Seaport analyst Jay Goldberg said. The incredibly high cost of Nvidia’s AI chips has meant cloud providers make lower profits renting out those chips than they could renting their own, analysts explained.

“Nvidia now has to compete with its customers,” Goldberg added.

While tech firms’ custom chips are broadly used to run internal AI workloads, Google reportedly began physically selling its AI chips called TPUs (tensor processing units) to a cloud provider in September — a move that would see it directly compete with the likes of Nvidia. DA Davidson analyst Gil Luria estimated Google’s TPU business, combined with its DeepMind AI segment, to be worth $900 billion and said it is “arguably one of Alphabet’s most valuable businesses.”

Nvidia’s (NVDA) own Big Tech customers are poised to capture a sizable slice of the AI chip market — a dynamic that could eventually dig into the chipmaker’s profit margins.

Tech giants have been making moves to bolster their in-house chipmaking businesses. ChatGPT developer OpenAI (OPAI.PVT) — a big customer of Nvidia’s chips by way of renting cloud space in Microsoft’s (MSFT) and CoreWeave’s (CRWV) data centers — said it will begin designing its own custom chips in partnership with Broadcom.

Meta (META) announced a plan in late September to acquire chip startup Rivos as it bolsters its own in-house chip efforts. Amazon (AMZN) said this summer that its massive data center project called Project Rainier, in which hundreds of thousands of its Trainium2 chips that will be used by AI developer Anthropic, is “well underway,” and analysts have said demand for its chips that have already been deployed in data centers from Anthropic has significantly risen.

While the lion’s share of the AI chip market is dominated by Nvidia’s GPUs (graphics processing units), tech companies led by Alphabet-owned Google (GOOGL, GOOG), Amazon, and Microsoft design custom chips in partnership with chipmakers Broadcom and Marvell Technology (MRVL).

The chips are cheaper and better optimized for those companies’ software, analysts explained. While these Big Tech cloud providers don’t sell physical, standalone chips to other companies like Nvidia does, the firms internally run their AI models off their own chips, and their cloud customers also have the option to run AI workloads using those custom chips at a lower cost.

JPMorgan said in a research note in June that custom chips designed by companies like Google, Amazon, Meta, and OpenAI will account for 45% of the AI chip market by 2028, up from 37% in 2024 and 40% in 2025. The rest of the chip market is held by producers of GPUs, namely Nvidia and its rival Advanced Micro Devices (AMD).

The “Magnificent Seven” names have a good reason to design their own chips.

“In the case of all the hyperscalers looking at custom silicon, the strategic angle here is they don’t want to be stuck behind an NVIDIA monopoly,” Seaport analyst Jay Goldberg said. The incredibly high cost of Nvidia’s AI chips has meant cloud providers make lower profits renting out those chips than they could renting their own, analysts explained.

“Nvidia now has to compete with its customers,” Goldberg added.

While tech firms’ custom chips are broadly used to run internal AI workloads, Google reportedly began physically selling its AI chips called TPUs (tensor processing units) to a cloud provider in September — a move that would see it directly compete with the likes of Nvidia. DA Davidson analyst Gil Luria estimated Google’s TPU business, combined with its DeepMind AI segment, to be worth $900 billion and said it is “arguably one of Alphabet’s most valuable businesses.”

Leave feedback about this