Nvidia (NVDA) is riding a wave of AI enthusiasm that has sent its stock price soaring to new highs after being battered in the early part of the year on fears of new AI models out of China and tariff threats.

On Friday, shares of Nvidia hit $157, up from $94 in April, marking a stunning turnaround for the world’s leading AI chip company.

The moves can be attributed to a number of factors turning in Nvidia’s favor, including the successful ramp of the buildout of its Blackwell chip line, the explosion in interest around so-called sovereign AI, and the company’s push into what it calls physical AI, or robotics.

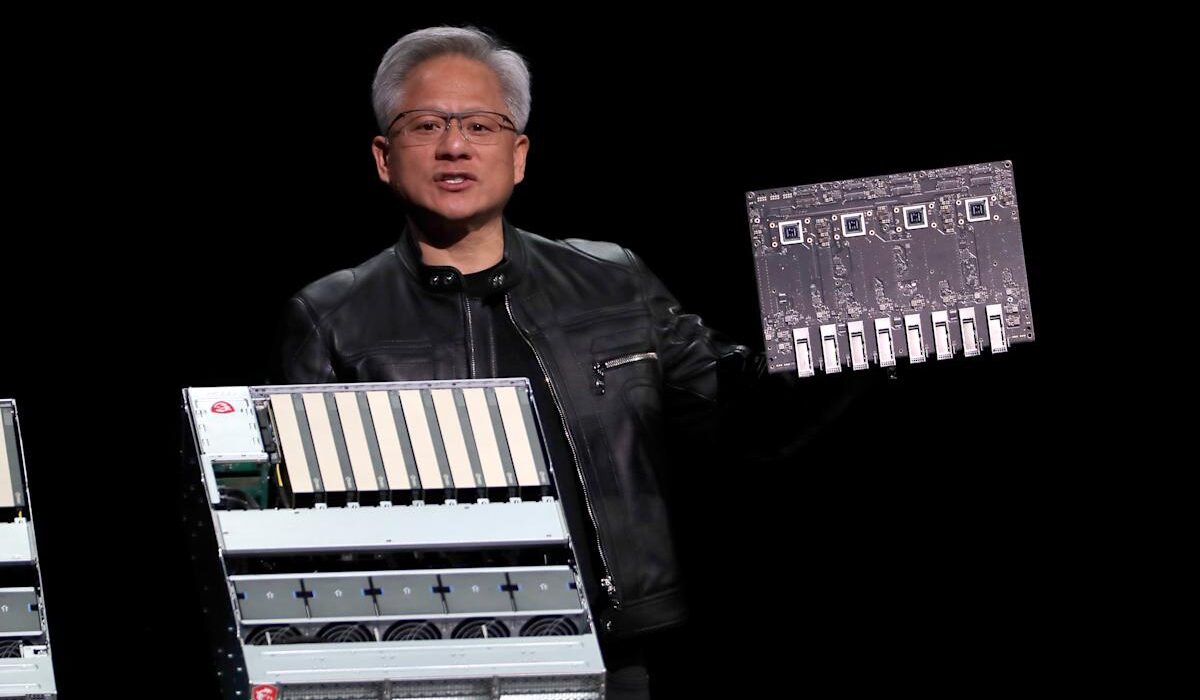

Nvidia’s Blackwell ramp, the process of building out chips and increasing overall volume, has been a major win for the company. During its GTC Paris event earlier this month, Nvidia said it is now shipping 1,000 Grace Blackwell (GB200) server racks per week and is on track for its transition to its next-generation Blackwell Ultra-powered GB300 servers.

Getting its chips and servers out the door as fast as possible has been key for Nvidia, especially after earlier delays as the company began to ramp production of Blackwell chips in late 2024.

Nvidia said the GB300 line of chips will be able to slot directly into GB200 servers, which the company claims will make it easier for its customers to upgrade to its latest offerings.

Nvidia also continues to benefit from the seemingly insatiable demand for its chips from hyperscalers, including Amazon (AMZN), Google (GOOG, GOOGL), Microsoft (MSFT), Meta (META), and xAI, among others. According to CFO Colette Kress, large cloud service providers accounted for just under 50% of the company’s data center sales in its fiscal first quarter. And with hyperscalers expected to spend billions more on their AI buildouts in the coming months, there’s little reason to believe that will slow down anytime soon.

CEO Jensen Huang is also betting big on the idea of sovereign AI, or AI data centers built in specific countries to power their own AI needs. Huang was on hand during President Trump’s visit to the Middle East in May, during which Trump announced that Saudi Arabia and the United Arab Emirates (UAE) will be able to purchase thousands of Nvidia chips for their data centers.

One of those projects, the UAE’s Project Stargate, could include 100,000 Nvidia GPUs, according to Reuters.

Huang also touted sovereign AI plans for Europe during GTC Paris.

“The company is establishing AI technology centers in Germany, Sweden, Italy, Spain, UK, and Finland, and working with regional cloud and telco partners in France, UK, and Germany to build new AI datacenters with [tens] of thousands of Grace Blackwell systems and GPUs,” Bernstein analyst Stacy Rasgon wrote in an investor note following the event.

“They are planning for 20 AI factories to be deployed in Europe, several at gigawatt scale, and sees European compute capacity growing by a factor of 10x over the next 2 years,” Rasgon added.

Huang and company also continue to push further into physical AI, with the CEO calling it a multitrillion-dollar opportunity. Physical AI is another way of referring to the software and computers needed to power things like humanoid robots and self-driving cars.

Nvidia offers both chips and the training information needed to run robots in factories and has been working in the automotive industry for years on self-driving car technologies.

But don’t expect to have a robot walking around your home anytime soon. Those kinds of bipedal butlers are likely years away from being something you can grab at your local Best Buy.

Importantly, Nvidia has managed to shake off fears over the Trump administration’s ban on sales of its chips to China. Despite taking a hefty charge on canceled orders, Wall Street analysts are more upbeat on the issue now that the ban is official and they no longer have to question whether one is coming or not. After all, there’s comfort in certainty.

Of course, Nvidia still faces the prospect of competition from rivals like AMD (AMD). And its own customers, including Amazon, Google, and Microsoft, are building or currently using their own in-house chips to take on Nvidia’s offerings, making for a more complicated relationship.

For now, however, Nvidia is rolling into summer with the wind at its back.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on X/Twitter at @DanielHowley.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance

Nvidia (NVDA) is riding a wave of AI enthusiasm that has sent its stock price soaring to new highs after being battered in the early part of the year on fears of new AI models out of China and tariff threats.

On Friday, shares of Nvidia hit $157, up from $94 in April, marking a stunning turnaround for the world’s leading AI chip company.

The moves can be attributed to a number of factors turning in Nvidia’s favor, including the successful ramp of the buildout of its Blackwell chip line, the explosion in interest around so-called sovereign AI, and the company’s push into what it calls physical AI, or robotics.

Nvidia’s Blackwell ramp, the process of building out chips and increasing overall volume, has been a major win for the company. During its GTC Paris event earlier this month, Nvidia said it is now shipping 1,000 Grace Blackwell (GB200) server racks per week and is on track for its transition to its next-generation Blackwell Ultra-powered GB300 servers.

Getting its chips and servers out the door as fast as possible has been key for Nvidia, especially after earlier delays as the company began to ramp production of Blackwell chips in late 2024.

Nvidia said the GB300 line of chips will be able to slot directly into GB200 servers, which the company claims will make it easier for its customers to upgrade to its latest offerings.

Nvidia also continues to benefit from the seemingly insatiable demand for its chips from hyperscalers, including Amazon (AMZN), Google (GOOG, GOOGL), Microsoft (MSFT), Meta (META), and xAI, among others. According to CFO Colette Kress, large cloud service providers accounted for just under 50% of the company’s data center sales in its fiscal first quarter. And with hyperscalers expected to spend billions more on their AI buildouts in the coming months, there’s little reason to believe that will slow down anytime soon.

CEO Jensen Huang is also betting big on the idea of sovereign AI, or AI data centers built in specific countries to power their own AI needs. Huang was on hand during President Trump’s visit to the Middle East in May, during which Trump announced that Saudi Arabia and the United Arab Emirates (UAE) will be able to purchase thousands of Nvidia chips for their data centers.

One of those projects, the UAE’s Project Stargate, could include 100,000 Nvidia GPUs, according to Reuters.

Huang also touted sovereign AI plans for Europe during GTC Paris.

“The company is establishing AI technology centers in Germany, Sweden, Italy, Spain, UK, and Finland, and working with regional cloud and telco partners in France, UK, and Germany to build new AI datacenters with [tens] of thousands of Grace Blackwell systems and GPUs,” Bernstein analyst Stacy Rasgon wrote in an investor note following the event.

“They are planning for 20 AI factories to be deployed in Europe, several at gigawatt scale, and sees European compute capacity growing by a factor of 10x over the next 2 years,” Rasgon added.

Huang and company also continue to push further into physical AI, with the CEO calling it a multitrillion-dollar opportunity. Physical AI is another way of referring to the software and computers needed to power things like humanoid robots and self-driving cars.

Nvidia offers both chips and the training information needed to run robots in factories and has been working in the automotive industry for years on self-driving car technologies.

But don’t expect to have a robot walking around your home anytime soon. Those kinds of bipedal butlers are likely years away from being something you can grab at your local Best Buy.

Importantly, Nvidia has managed to shake off fears over the Trump administration’s ban on sales of its chips to China. Despite taking a hefty charge on canceled orders, Wall Street analysts are more upbeat on the issue now that the ban is official and they no longer have to question whether one is coming or not. After all, there’s comfort in certainty.

Of course, Nvidia still faces the prospect of competition from rivals like AMD (AMD). And its own customers, including Amazon, Google, and Microsoft, are building or currently using their own in-house chips to take on Nvidia’s offerings, making for a more complicated relationship.

For now, however, Nvidia is rolling into summer with the wind at its back.

Email Daniel Howley at dhowley@yahoofinance.com. Follow him on X/Twitter at @DanielHowley.

Click here for the latest technology news that will impact the stock market

Read the latest financial and business news from Yahoo Finance