(Bloomberg) — In the stock market’s rarefied air where mega-cap technology behemoths reside, Tesla Inc. stands out — but for all the wrong reasons. Chief among them is its stunning lack of earnings growth while its stock price continues to soar.

The Elon Musk-led electric vehicle-maker is expected to post a 25% drop in third-quarter profits from a year ago when it reports earnings Wednesday afternoon, according to data compiled by Bloomberg. The decline is nothing new, as Tesla’s results have been in retreat for multiple years.

Most Read from Bloomberg

What is notable, however, is the way Tesla shares have been impervious to the drop, more than doubling in the past 12 months. It’s a tribute to Musk’s success in turning investors’ attention away from selling EVs and toward his vision of an artificial intelligence company focused on self-driving cars and humanoid robots. The stock fell as much as 3.1% Wednesday ahead of the results due after the market close.

“The Tesla story is never really about the current quarter, but rather the broader expectations that it can keep innovating and pivoting to the future,” said Daniel Newman, chief executive officer of the technology research and advisory firm the Futurum Group.

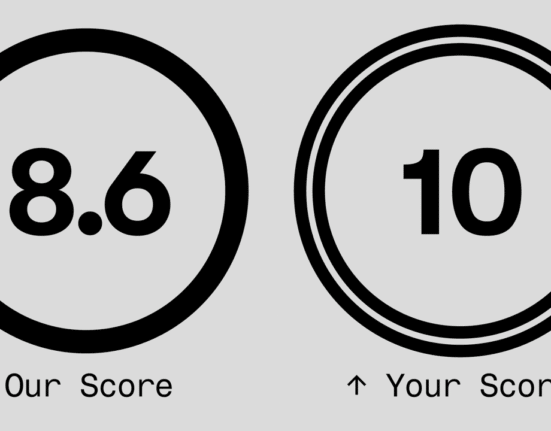

This hope for the future while discounting the present has taken Tesla’s market valuation to dizzying heights. The shares trade at a whopping 195 times expected earnings over the next 12 months as of Tuesday’s close, up from less than 80 times in April. It’s the fourth most-expensive stock in the S&P 500 Index, trailing only Warner Bros Discovery Inc., Palantir Technologies Inc. and Boeing Co.

The company’s valuation is head and shoulders above its peers in the Magnificent Seven: Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp. and Nvidia Corp. The Bloomberg Magnificent Seven Index trades roughly 33 times expected earnings as of Tuesday’s close. After Tesla, the next highest valuation in the group belongs to Apple at just over 32 times.

Tesla’s problem is that right now it’s a company that manufactures cars, trucks, solar panels and energy storage systems. Its AI vision is years, if not decades, away from generating sales, much less profits. So EVs are the primary way the company can bring in the cash required for its AI investments. And that business is facing slowing demand as the Trump administration pulls federal incentives that had encouraged EV adoption, such as a $7,500 tax credit for buying EVs that expired in September.

(Bloomberg) — In the stock market’s rarefied air where mega-cap technology behemoths reside, Tesla Inc. stands out — but for all the wrong reasons. Chief among them is its stunning lack of earnings growth while its stock price continues to soar.

The Elon Musk-led electric vehicle-maker is expected to post a 25% drop in third-quarter profits from a year ago when it reports earnings Wednesday afternoon, according to data compiled by Bloomberg. The decline is nothing new, as Tesla’s results have been in retreat for multiple years.

Most Read from Bloomberg

What is notable, however, is the way Tesla shares have been impervious to the drop, more than doubling in the past 12 months. It’s a tribute to Musk’s success in turning investors’ attention away from selling EVs and toward his vision of an artificial intelligence company focused on self-driving cars and humanoid robots. The stock fell as much as 3.1% Wednesday ahead of the results due after the market close.

“The Tesla story is never really about the current quarter, but rather the broader expectations that it can keep innovating and pivoting to the future,” said Daniel Newman, chief executive officer of the technology research and advisory firm the Futurum Group.

This hope for the future while discounting the present has taken Tesla’s market valuation to dizzying heights. The shares trade at a whopping 195 times expected earnings over the next 12 months as of Tuesday’s close, up from less than 80 times in April. It’s the fourth most-expensive stock in the S&P 500 Index, trailing only Warner Bros Discovery Inc., Palantir Technologies Inc. and Boeing Co.

The company’s valuation is head and shoulders above its peers in the Magnificent Seven: Alphabet Inc., Amazon.com Inc., Apple Inc., Meta Platforms Inc., Microsoft Corp. and Nvidia Corp. The Bloomberg Magnificent Seven Index trades roughly 33 times expected earnings as of Tuesday’s close. After Tesla, the next highest valuation in the group belongs to Apple at just over 32 times.

Tesla’s problem is that right now it’s a company that manufactures cars, trucks, solar panels and energy storage systems. Its AI vision is years, if not decades, away from generating sales, much less profits. So EVs are the primary way the company can bring in the cash required for its AI investments. And that business is facing slowing demand as the Trump administration pulls federal incentives that had encouraged EV adoption, such as a $7,500 tax credit for buying EVs that expired in September.

Leave feedback about this