This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Something happens when you squint at the global boom in AI spending.

Behind the astronomical deals of epoch-defining technology are the ways people are actually using AI. In just the last few weeks, social feeds and news headlines have highlighted image-generation slop, erotica, shopping bots, and automated schoolwork. This is hardly the bright future we were promised.

The embarrassing mismatch between AI company pitch and AI company work product is on full display, and to some signals a business plan gone awry, or the painful absence of one.

That’s the contrarian take, however, not Wall Street’s, which is worth reiterating.

The market is clearly on the side of the AI transition here. Just look at the S&P 500 (^GSPC): still flying high, despite the best efforts of a trade war and fresh warnings from the Fed. Scoff at the stilted gestures of LLMs and recoil from their confident hallucinations if you want, but the optimistic reading says that these are just baby steps — and the baby is tech’s version of Michael Jordan.

The bull thesis suggests that half-baked use cases, which may look weak in light of the scope of the AI infrastructure buildout, are just the earliest iterations of more profound developments to come. And the commitment to that infrastructure buildout is what is going to finish that baking, so to speak.

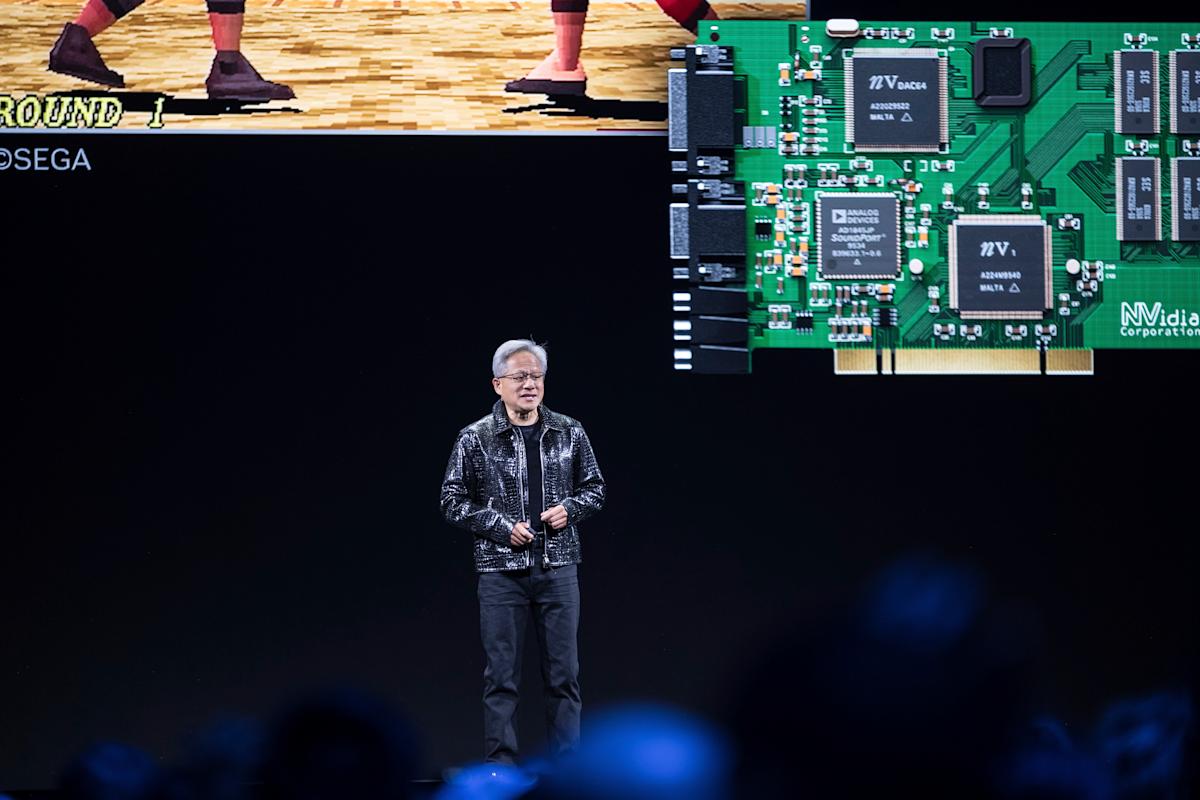

Which brings us to Thursday. Chip stocks rallied, fueled by the optimistic outlook of TSMC (TSM). The go-to contract chipmaker for Nvidia (NVDA) and Apple (AAPL) raised revenue growth projections for the second time this year. The company reported a nearly 40% surge in quarterly profit in the last quarter, a record.

Its peers and familiars in the AI stock basket rose too. Investors received more financial assurance that the AI trade is thriving as C.C. Wei, the CEO of TSMC, told analysts that “conviction in the AI megatrend is strengthening.”

But skeptics persist. It’s the tech platforms and IT firms that fuel demand for the companies in charge of AI chipmaking and data infrastructure — not the customers. In what some analysts have criticized as a circular flow of dealmaking, in which providers invest in their customers, and vice versa, the entire AI industry has come to resemble a self-investment money machine.

And even before the latest batch of business entanglements, the market dynamics of AI at the industrial-supplier level versus AI demand at the consumer level were peculiar. Nvidia’s success, for instance, isn’t directly tied to consumers clawing for the latest chatbot update from OpenAI’s ChatGPT or Google’s Gemini. Rather, it comes from tech companies placing large orders for Nvidia’s state-of-the-art chips.

This is The Takeaway from today’s Morning Brief, which you can sign up to receive in your inbox every morning along with:

Something happens when you squint at the global boom in AI spending.

Behind the astronomical deals of epoch-defining technology are the ways people are actually using AI. In just the last few weeks, social feeds and news headlines have highlighted image-generation slop, erotica, shopping bots, and automated schoolwork. This is hardly the bright future we were promised.

The embarrassing mismatch between AI company pitch and AI company work product is on full display, and to some signals a business plan gone awry, or the painful absence of one.

That’s the contrarian take, however, not Wall Street’s, which is worth reiterating.

The market is clearly on the side of the AI transition here. Just look at the S&P 500 (^GSPC): still flying high, despite the best efforts of a trade war and fresh warnings from the Fed. Scoff at the stilted gestures of LLMs and recoil from their confident hallucinations if you want, but the optimistic reading says that these are just baby steps — and the baby is tech’s version of Michael Jordan.

The bull thesis suggests that half-baked use cases, which may look weak in light of the scope of the AI infrastructure buildout, are just the earliest iterations of more profound developments to come. And the commitment to that infrastructure buildout is what is going to finish that baking, so to speak.

Which brings us to Thursday. Chip stocks rallied, fueled by the optimistic outlook of TSMC (TSM). The go-to contract chipmaker for Nvidia (NVDA) and Apple (AAPL) raised revenue growth projections for the second time this year. The company reported a nearly 40% surge in quarterly profit in the last quarter, a record.

Its peers and familiars in the AI stock basket rose too. Investors received more financial assurance that the AI trade is thriving as C.C. Wei, the CEO of TSMC, told analysts that “conviction in the AI megatrend is strengthening.”

But skeptics persist. It’s the tech platforms and IT firms that fuel demand for the companies in charge of AI chipmaking and data infrastructure — not the customers. In what some analysts have criticized as a circular flow of dealmaking, in which providers invest in their customers, and vice versa, the entire AI industry has come to resemble a self-investment money machine.

And even before the latest batch of business entanglements, the market dynamics of AI at the industrial-supplier level versus AI demand at the consumer level were peculiar. Nvidia’s success, for instance, isn’t directly tied to consumers clawing for the latest chatbot update from OpenAI’s ChatGPT or Google’s Gemini. Rather, it comes from tech companies placing large orders for Nvidia’s state-of-the-art chips.

Leave feedback about this