(Bloomberg) — US technology stocks face growing risks as investors seek to cash in on this year’s record-breaking rally, according to Citigroup Inc. strategists.

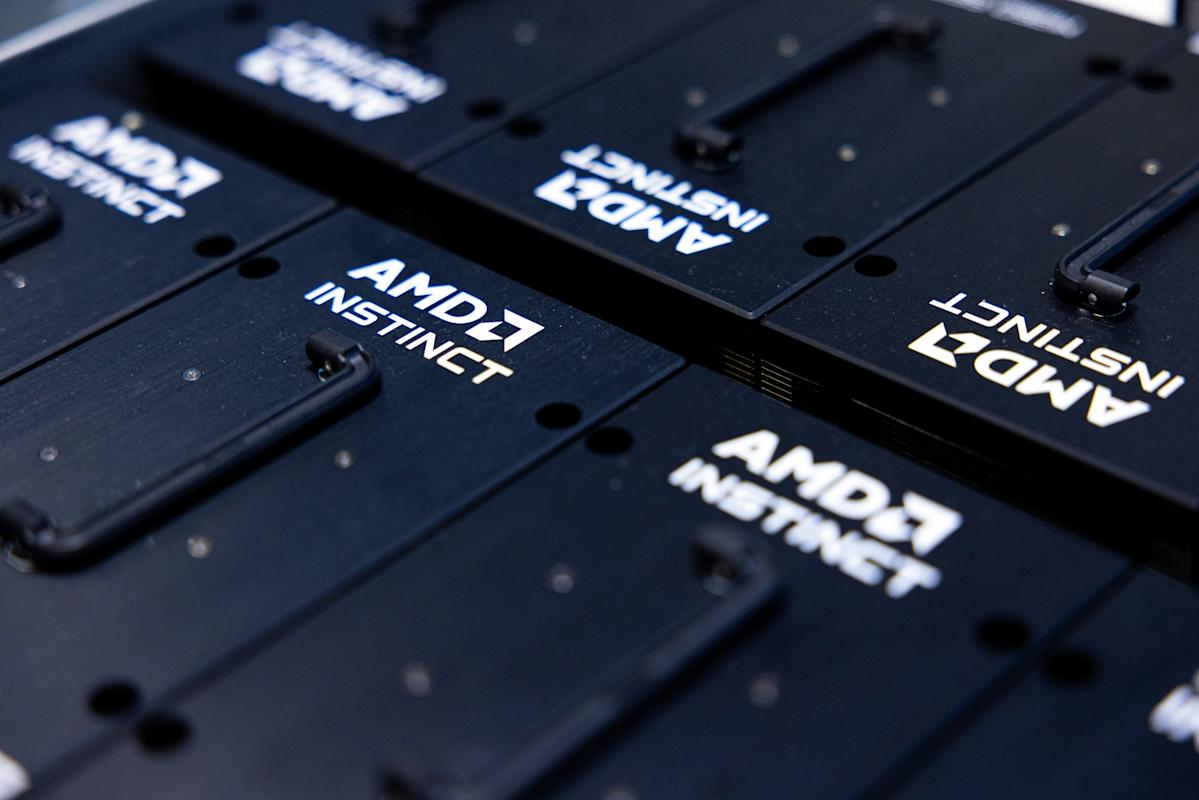

The Nasdaq 100 (^NDX) is most vulnerable to the threat, after soaring 46% from its April lows thanks to resurgent enthusiasm around advances in artificial intelligence. The tech-heavy benchmark set its latest record on Monday after Advanced Micro Devices Inc.’s (AMD) blockbuster deal with OpenAI (OPAI.PVT).

Most Read from Bloomberg

“Profit-taking risks have rapidly risen across markets, and are particularly elevated for Nasdaq, potentially hampering further upside,” the Citi team led by Chris Montagu wrote in a note.

Optimism over AI keeps propelling the stock market to new highs, eclipsing concerns such as the US government shutdown or the lingering threat to the economy from trade tariffs. The Nasdaq 100 has already closed at a record 30 times this year through Monday, according to data compiled by Bloomberg. Last year, the benchmark set 45 closing peaks.

For the moment, investors continue to add to wagers on stock market gains.

Goldman Sachs Group Inc.’s (GS) trading desk reported last week that bullish sentiment among the firm’s clients is the highest since December, with 40% of those surveyed expecting the S&P 500 (^GSPC) to outperform this month. A sentiment tracker compiled by Barclays Plc (BCS) has been sitting near a level that indicates exuberance. A similar Bloomberg Intelligence measure is back to a “manic” zone that’s preceded lukewarm returns in the past.

Citi’s latest weekly snapshot showed risk flows resumed for US equities, with new long positioning taking the upper hand, the bank’s strategists wrote. “Bullish positioning on both large and small caps is on the rise,” they said.

—With assistance from Sagarika Jaisinghani and Jan-Patrick Barnert.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

(Bloomberg) — US technology stocks face growing risks as investors seek to cash in on this year’s record-breaking rally, according to Citigroup Inc. strategists.

The Nasdaq 100 (^NDX) is most vulnerable to the threat, after soaring 46% from its April lows thanks to resurgent enthusiasm around advances in artificial intelligence. The tech-heavy benchmark set its latest record on Monday after Advanced Micro Devices Inc.’s (AMD) blockbuster deal with OpenAI (OPAI.PVT).

Most Read from Bloomberg

“Profit-taking risks have rapidly risen across markets, and are particularly elevated for Nasdaq, potentially hampering further upside,” the Citi team led by Chris Montagu wrote in a note.

Optimism over AI keeps propelling the stock market to new highs, eclipsing concerns such as the US government shutdown or the lingering threat to the economy from trade tariffs. The Nasdaq 100 has already closed at a record 30 times this year through Monday, according to data compiled by Bloomberg. Last year, the benchmark set 45 closing peaks.

For the moment, investors continue to add to wagers on stock market gains.

Goldman Sachs Group Inc.’s (GS) trading desk reported last week that bullish sentiment among the firm’s clients is the highest since December, with 40% of those surveyed expecting the S&P 500 (^GSPC) to outperform this month. A sentiment tracker compiled by Barclays Plc (BCS) has been sitting near a level that indicates exuberance. A similar Bloomberg Intelligence measure is back to a “manic” zone that’s preceded lukewarm returns in the past.

Citi’s latest weekly snapshot showed risk flows resumed for US equities, with new long positioning taking the upper hand, the bank’s strategists wrote. “Bullish positioning on both large and small caps is on the rise,” they said.

—With assistance from Sagarika Jaisinghani and Jan-Patrick Barnert.

Most Read from Bloomberg Businessweek

©2025 Bloomberg L.P.

Leave feedback about this